Is It Illegal To Charge Insurance Patients Different Prices For The Same Service

Cash discounts for people who don't have or employ insurance could save patients hundreds, but healthcare providers are far from universal on what they let and how much it tin can save yous.

BOISE, Idaho — Healthcare and insurance is always a convoluted, confusing and expensive maze to navigate, regardless if you're insured or not.

Even with insurance, many Idahoans accept heaven-loftier premiums and deductibles notwithstanding continue to pay and so much out of pocket.

Due to how expensive healthcare costs are, people are turning to a little-known payment method that could save patients hundreds of dollars if they know their options.

7Investigates dug into how people are paying bills with cash versus using insurance.

Nosotros discovered some health care providers' cash or self-pay discounts are cheaper than what you'd pay using your insurance. People with loftier deductibles are finding it's amend to pay their bills with cash or card than let billing departments send it to their insurance.

Insurance does have a hugely of import role in case annihilation catastrophic happens, so this is not an encouragement to finish having insurance. Merely KTVB does want you to exist enlightened of your options and know if you lot ask a couple actress questions, it could relieve you hundreds on medical costs.

Idahoans' experiences saving money

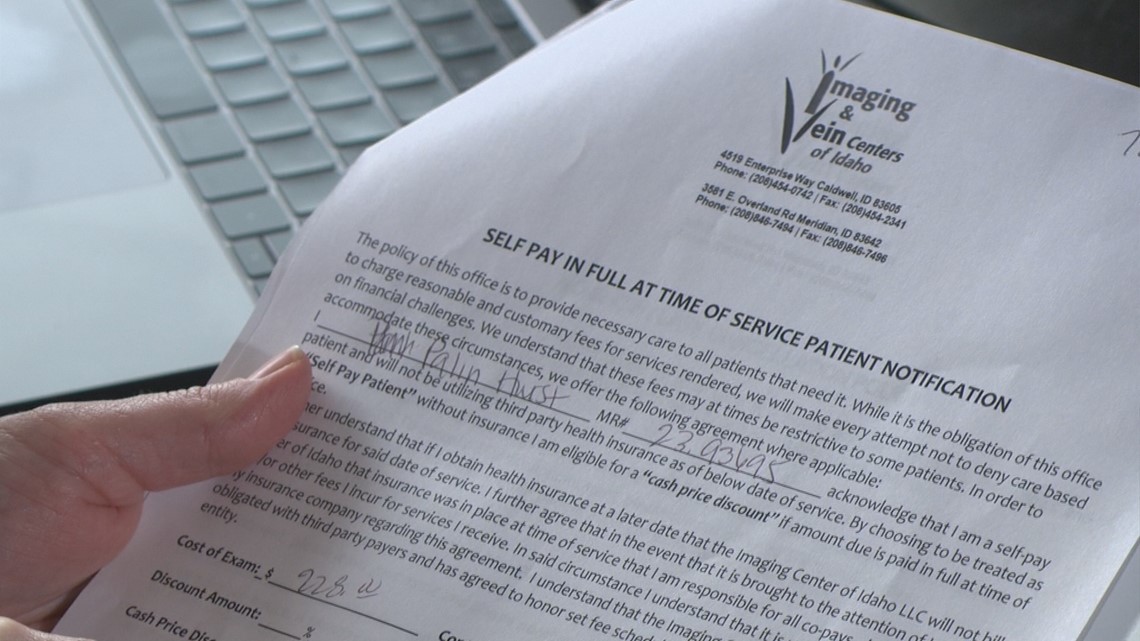

When their daughter's doctor said she needed X-rays for her dorsum, Crystal Hurst didn't call up twice.

"I automatically was like, washed, it'southward my kid, at that place's no question. I was just going to arrive the car and go," Crystal said.

She called her hubby Tyler to let him know she was going to drib by St. Luke's.

"I idea, geez, 10-rays can be kind of expensive and we have a deductible - they're not going to be covered until after we meet our deductible - and so we're probably going to finish upward having to pay for them," Tyler Hurst said. "My idea procedure is: is at that place a better way to do this?"

Tyler says he just typed "Boise inexpensive X-rays" into the Google search engine, and imaging centers populated. He gave his daughter'south medico a phone call, who Tyler says told him they could go ahead and get the X-rays done elsewhere and the images would be accepted.

The Hursts settled on Imaging Center of Idaho, where they plant online that costs were much cheaper than at the hospital. Not only was it a bargain, but the Imaging Center of Idaho offered an incentive for their daughter'south four different images.

Crystal says they told her if she paid cash correct hither, right now, and didn't go through insurance, she'll pay even less.

"If y'all paid in full today, like no payments or annihilation, it'south $55. Merely if they billed it through insurance information technology's $228. It's messed up," Crystal said.

The Hursts' deductible is incredibly and considering their programme doesn't cover X-rays at all earlier hitting it, self-paying $55 up front end fabricated more sense for them.

"Where's the disconnect? What's going on that there is such a large price gap in what we're paying equally consumers if we pay versus what insurance companies are paying?" Crystal said.

The cash payment pick allowed the Hursts to avoid using their insurance and save hundreds, just the healthcare organisation doesn't easily item why there is such a large discrepancy in payment amounts through this option.

"I only don't understand why it would exist so much more than going through insurance versus but paying cash. It's the same procedure either manner," Tyler added.

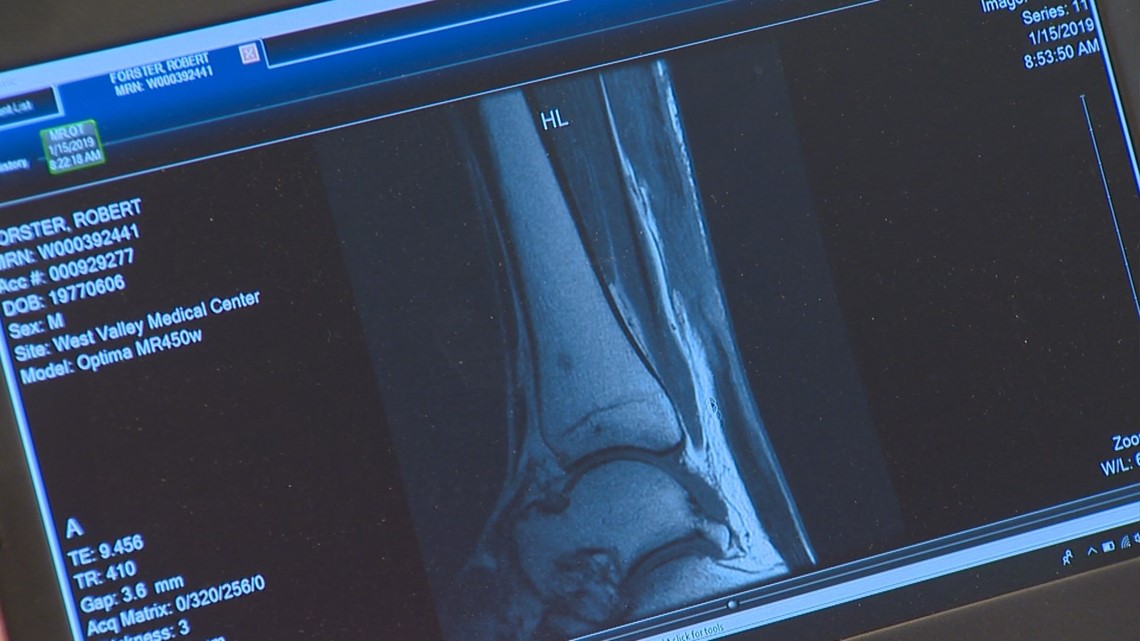

Rob Forster as well discovered he had options and encountered a similar situation..

A medico told him he might have torn his Achilles skiing at Tamarack with his kids, but made sure he did his research earlier getting an MRI done.

"Eventually I settled on a provider. Interestingly plenty they give an 89-percent discount if I don't have insurance, brings the cost of the MRI down substantially," Forster said.

With the discount, he said it was going to total out to near $340.

"That's an incentive for me to not have insurance," Forster added.

Forster says West Valley Medical Center was going to pecker his insurance much more than that, around $1,300. He researched and plant under his insurance policy, his out-of-pocket for the service was far more than paying greenbacks upfront.

"It was also far more expensive than a competing provider that lists their cash price on their web site," he added.

"So I got the cash discount only because they didn't know nearly my insurance," Forster said.

The MRI showed he needed surgery. At that point he fessed upward he had coverage, knowing with the high price of surgery, he'd striking his deductible and out-of-pocket max.

"Insurance for me is actually only valuable for what happened here, for something major," Forster added.

Not using his insurance allowed Forster to avoid higher costs, but he was able to navigate the system and determine when it made financial sense to bill his insurance.

What are cash discounts, cocky-pay discounts, and uninsured discounts?

In some cases, greenbacks discounts and self-pay discounts can be less of a hit to your wallet than negotiated individual insurance rates before meeting your deductible.

This actually just applies to common outpatient procedures, tests, and images. A number of health care providers and systems will offering discounts for patients for major surgeries and hospitalizations, but information technology could be around the same price – or more – than what you'd pay out-of-pocket with insurance.

Of class, it all depends on your specific individual health insurance policy.

The caveat hither: typically you can only get the greenbacks or self-pay cost if you don't loop in your insurance. Many providers just offer it if you're uninsured or, like Forster, don't disclose yous have insurance – which is legal.

But remember, cash payments that aren't submitted to insurance volition non exist practical toward your deductible, rendering you vulnerable should annihilation catastrophic or major happen.

Treasure Valley providers and their discounts

- Imaging Centre of Idaho, where the Hursts got X-rays washed, calls their discount a "cocky-pay" discount. Primary Operations Officer Charles Eldredge tells 7Investigates self-pay prices are offered to people without insurance initially, but if for some reason an insured person chooses not to employ it they can pay the self-pay cost. He says sometimes the cash discount is less expensive, sometimes it'southward more – it only depends on a patient'south insurance programme. In a statement, Eldredge said of their cocky-pay discount: "This amount varies depending on the modality "exam"... If a patient does not have insurance and cannot pay in total at time of service our policy is to offer a 30% discount off the total exam charge."

- Intermountain Medical Imaging is an culling option for imaging services. Rachel Bergmann, Director of Marketing & Professional person Relations, says their cash discounts are more often than not 30-percent off their billable rates. Bergmann says boosted factors considered when determining cash pricing include contracted rates with participating insurance providers, as well every bit Medicare rates. When asked whether that was generally more, less or the same as their negotiated insurance rates, she said, "Based on the broad variety of exams and insurance contracts that we participate with, information technology would be well-nigh impossible to answer that question accurately."

- West Valley says their "uninsured" discount ranges between 45 to 89 percentage and does utilize to nigh hospital services. Wendy McClain, Director of Marketing/PR, says it is adamant on an private case-by-instance footing "where multiple variables are considered". They say when patients are insured they are obligated to pecker their insurance company in accordance with the member agreement each patient signs when they select a health plan.

W Valley also offers a 10-per centum "prompt pay" discount for insured patients who pay their portion of the estimated bill in full on the day infirmary services are provided.

- At St. Luke's Health System, discounts for uninsured patients are 30 percent on all services. They say that'due south more often than not correct around what you'd pay going through insurance. They say they don't want to create an "odd incentive" where cash discounts are significantly less than negotiated insurance rates because it sends the message that you shouldn't have insurance.

- Saint Alphonsus says that's too the case in that location; like to St. Luke'due south, depending on their contracts with payors, you could pay less or more than than their "uninsured disbelieve". Patient Financial Services Regional Manager Laurea Howell tells 7Investigates that as a non-profit they are required past constabulary to never charge a patient full toll of they don't accept insurance. Their thirty-pct self-pay/uninsured discount is on services beyond the board and is taken at the indicate of billing. They practise not exercise a "prompt pay" upfront disbelieve.

- At Saltzer Medical Group, they say cash discounts are 25-percent across the lath – comparable but sometimes less or sometimes more than their negotiated insurance prices. Their cash discount applies to every service and is given when the payment is made at the time of service.

"The biggest reasons that we run across discounted prices in greenbacks pay is because as an establishment we get paid earlier and nosotros get paid more and nosotros tin can put coin to piece of work improve and more than effectively," Dr. Brian D. Affleck, a md with Saltzer Medical Group said. "When you are looking at insurance at that place virtually always are delays and, in fact, if I submitted a nib today information technology probably would be 90 days or greater before we would actually see that money."

Dr. Affleck says Saltzer does allow insured patients to get the cash disbelieve.

"At that place's no reason that we wouldn't because if it's good for the patient and it'southward good for us," Affleck added.

Do 'the ask'

To get a discount similar Forster and the Hursts, yous must ask what healthcare providers' and health care systems' cash, self-pay or uninsured discounts are.

"The patient would need to ask for it though and, you lot know, most cash payers are going to exercise exactly that: they're going to tell u.s.a. 'I want to pay cash' and then it opens a whole variety of options to us for them specifically. Only yous've got to do the asking," Dr. Affleck said.

"If I'chiliad not going to hitting the high deductible and get some benefit as a event of hitting my deductible then I really want to store effectually and make sure I comprise my costs," Forster told 7Investigates.

It'due south up to patients to ask healthcare providers' billing departments or hospitals' fiscal consultants about their discounted price, specially if yous have a loftier deductible.

"If there is a cash option that's cheaper and you lot know you're never going to hit your deductible, I recall that information technology's something that we all need to be made aware of. Yeah, yous have other options," Crystal Hurst said.

"I practice think consumers should take the time and ask, practise the research, ask the questions," Tyler Hurst added. "I asked ane or two extra questions and information technology saved us a few hundred bucks."

The tangible frustration amid patients we spoke with is this: they feel we, every bit Americans, do non know the true cost of health intendance anymore.

"Anywhere you go in the world to buy something you know the toll before y'all pay for it, except for health intendance," Hurst added.

Tips for consumers

- Shopping around to compare prices and researching beforehand are your all-time bets.

- Be persistent and ask actress questions to find the estimated cash price, also every bit the cost estimate for the service if you were to apply your health insurance.

- Providers may not be transparent considering they have contracts with your insurer and that may be a contract violation.

- Whenever you can, enquire your provider the code for your service.

- Await upward whether your insurance-negotiated prices and cash rates are listed on a website like Clear Health Costs or Healthcare Bluebook.

- Check your insurance company's online price figurer tool or phone call them, though it's not guaranteed y'all'll find the true cost because prices of services fluctuate.

Pricing estimates and financial assistance

W Valley Medical Eye has a Patient Pricing link on the bottom of their dwelling house folio explaining their billing procedure and pricing estimates for uninsured and insured patients. They say both insured and uninsured patients can make monthly patments wihout interest of charge for up to 60 months.

On their website in the 'insured' section, they ask insured patients to contact their Service Centre at (800) 370-1983 in order to get the near accurate estimate. In the 'uninsured' department they provide a list of common inpatient and outpatient services and pricing with a toll range.

West Valley provides financial counselors to patients to evaluate their eligibility for various programs. Along with an uninsured discount, the medical center also provides a Charity Disbelieve for those who truly cannot afford care.

St. Luke's provides price estimates for patients, offering a toll list with the average charge of common medical services and procedures. Notwithstanding, they are non a guarantee of final charges considering actual charges always vary. Your truthful financial responsibility depends on your insurance plan, if you are covered.

St. Luke'due south offers financial aid to people who are low-income, uninsured or underinsured and need assistance paying their bills. Different from the greenbacks discount, there are several requirements for a patient to be eligible for fiscal help, including completing a Fiscal Care Application and submitting required documentation and have an income at or below 400-percent of the Federal Poverty Limit.

Financial advocates can also help patients identify what resources are bachelor to them, which can help patients prepare financially before their handling. Like W Valley, they can help yous sympathize your coverage and determine if you qualify for programs. To talk to a fiscal advocate, call Boise at (208) 381-1425 or Superlative at (208) 706-2147.

You can also get a toll guess through Saint Alphonsus to meliorate understand your out-of-pocket costs. You tin call (208) 367-Toll, get to their Online Price Estimator (similar to the other two formerly mentioned), or e-mail. The onlinetool only reviews the specific service or procedure and provides an average estimate of the charge, without assessing your insurance or out-of-pocket expenses.

Saint Alphonsus offers a Financial Help Program as a resource for people who need aid covering the cost of care. If you don't accept insurance or have limited insurance, Patient Financial Services can help by establishing a depression interest loan, help determine if y'all qualify for a public assistance program, or make up one's mind if y'all qualify for a full or fractional discount off your hospital nib. To make up one's mind whether yous authorize for financial support, you'll be asked to complete an application and provide supporting documentation.

Is It Illegal To Charge Insurance Patients Different Prices For The Same Service,

Source: https://www.ktvb.com/article/news/health/paying-with-cash-or-insurance-little-known-way-to-possibly-save-on-medical-bills/277-3075953b-6e78-4587-8f0c-ef0da35554b2

Posted by: mackgresto1958.blogspot.com

0 Response to "Is It Illegal To Charge Insurance Patients Different Prices For The Same Service"

Post a Comment